Mortgagequestions is an online platform that enables borrowers to manage their mortgage loans conveniently. In this article, we will discuss how to access your account and navigate the website with ease. We will also look at the benefits of using Mortgagequestions.com and answer some common questions users may have.

Mortgagequestions.com is a website designed to help borrowers manage their mortgage loans easily. With this platform, users can access their loan information, make payments, and even update their personal information. It is a one-stop shop for everything mortgage-related.

Mortgagequestions.com is a useful tool for homeowners looking to manage their mortgage accounts online. By following the steps outlined in this article, you can easily register, log in, and navigate the website to efficiently manage your mortgage account. Additionally, the security measures taken by Mortgagequestions.com ensure the safety of your personal and financial information.

Mortgagequestions is a valuable resource for homeowners who want to manage their mortgage accounts online. With its user-friendly interface and helpful resources, it is easy to register, log in, and navigate the website. Additionally, the security measures taken by Mortgagequestions.com ensure that your personal and financial information is protected. Whether you need to make a payment, update your account information, or access your mortgage statement, Mortgagequestions.com is the perfect tool for homeowners looking to manage their mortgages efficiently.

What is Mortgagequestions?

Mortgagequestions is a website that provides a convenient way for homeowners to manage their mortgage accounts online. The website is owned by PHH Mortgage, which is a subsidiary of Ocwen Financial Corporation. PHH Mortgage is a well-known mortgage company that has been in business since 1946 and has helped millions of homeowners finance their homes.

MortgageQuestions is an online service provided by PHH Mortgage, a top mortgage lender in the United States. The website aims to assist borrowers in managing their mortgage loans effectively. MortgageQuestions provides a range of services to its users, including online payments, account information, loan history, and other features.

What is a Mortgage Loan?

A Mortgage is a type of loan that is used to purchase or maintain a home, plot of land, or other types of Real Estate property. It is the written agreement that gives a Mortgage Lender the right to take home if the homebuyer doesn’t repay the money they lend them at the terms they agreed on. Mortgages are secured loans that are backed by collateral. If a Borrower falls behind on their loan payments or fails to meet other mortgage terms, the Mortgage Loan agreement gives the mortgage lenders the right to respond to the Home. A Borrower needs to apply for a mortgage through their preferred lenders and ensure that they meet various requirements including minimum credit scores and down payments.

Types of Mortgage Loan

There are several types of Mortgage Loans, each has different requirements, interest rate ranges, and benefits. The two main categories of Mortgage Loans are Conforming loans and Non-conforming loans. The Non-conforming loans include Government-backed loans, Jumbo loans, and Non-prime Mortgages.

Conventional Mortgage Loans

A Conventional Mortgage Loan is a Mortgage Loan that is not insured by the Federal Government. Most Conventional Mortgage Loans are Conforming Loans. In these Mortgage Loans, a Mortgage lender is issuing a Loan without a government agency’s Guarantee. In this Loan, the Mortgage meets the requirements set by Fannie Mae and Freddie Mac. Conventional Mortgage Loans are the most popular choice among homebuyers. Depending upon the finances, homeownership history, and credit score, homebuyers can get a conventional loan with a 3% down payment, which can get them into a home sooner.

Government-Insured Mortgage Loans

Government-backed Mortgage Loans are especially attractive to first-time and low- to moderate-income homebuyers and borrowers with smaller savings and credit issues.

FHA Loans

FHA Loans are backed by the Federal Housing Administration. These Mortgage Loans are popular because they have low down payment and credit score requirements. Homebuyers can get FHA Loans with a 3.5% down payment and a 580 credit score.

VA Loans

VA Loans are backed by the Department of Veterans Affairs. These Mortgage Loans are beneficial for qualified active-duty military members, reservists, National Guard members, veterans, and their surviving spouses. VA Loans are a great option because if the homebuyers qualify, they can buy a home for a 0% down payment and won’t pay mortgage insurance.

USDA Loans

USDA Loans are backed by the United States Department of Agriculture. These Mortgage Loans only apply to Homes in USDA-approved rural and suburban areas. To qualify for the USDA Mortgage Loans the homebuyer’s household income can’t exceed 115% of an area’s median income. Homebuyers can buy a home for a 0% down payment and for some homebuyers, USDA’s required USDA Guarantee Fee will cost less than the FHA mortgage insurance premium.

Fixed-Rate Vs. Adjustable-Rate Mortgage Loans

Most Mortgage Loans are either Fixed-Rate Mortgage or Adjustable-Rate Mortgage.

Fixed-Rate Mortgage

The Term Fixed-Rate Mortgage refers to home loans that have fixed interest rates for the entire term of the loan. Fixed-rate Mortgages may be open or closed with specific terms of 15 or 30 years or they may run for a length of time agreed upon by the lender and borrower.

Adjustable-rate Mortgages

An Adjustable-rate Mortgage is a Home Loan with an interest rate that can fluctuate periodically based on the performance of a specific benchmark. Adjustable-rate mortgages are also called variable-rate or floating mortgages. Most adjustable-rate mortgages have 30-year terms and offer an initial fixed-rate period that usually lasts 5, 7, or 10 years. After the initial fixed-rate period ends, the interest rate will adjust up or down every 6 months to a year.

What Is a Second Mortgage?

A Second Mortgage is a home loan secured by a home that will be or already is secured by a first Mortgage. The Most common types of Second mortgages Include home equity lines of credit (HELOCs) and home equity loans. The second Mortgage can be combined with a first mortgage to buy, refinance, or renovate a home.

How To Qualify For A Mortgage Loan?

The Mortgage Lenders look at four aspects of finances to assess whether homebuyers meet the minimum mortgage requirements for a mortgage preapproval:

Credit Score

The homebuyers will need to get their credit score up to 620 or higher to qualify for the Conventional Mortgage Loan. Homeowners need to keep their credit balances low and pay everything on time to avoid score drops. If the homebuyers can boost their credit score to 780, they will get the best interest rates possible with a conventional loan.

Debt-to-income (DTI) Ratio

Conventional lenders set a maximum 43% DTI ratio, but the homeowners may get an exception if they have lots of extra savings and a high credit score. The Mortgage lenders divide homeowners’ monthly income by their monthly debt (including new mortgage payments) to determine the debt-to-income (DTI) ratio.

Income and Employment History

The homebuyer’s steady employment history for the last two years shows lenders that they have the stability to afford a regular monthly payment. During the mortgage process, the borrowers need to Keep copies of their paystubs, W-2s, and federal tax returns handy.

Minimum Down Payment

For the conventional loan, the minimum down payment is 3%, however, it can pay to put down more if they’re able. The borrowers will snag the best conventional mortgage rate if they have a 780 credit score and a 25% down payment.

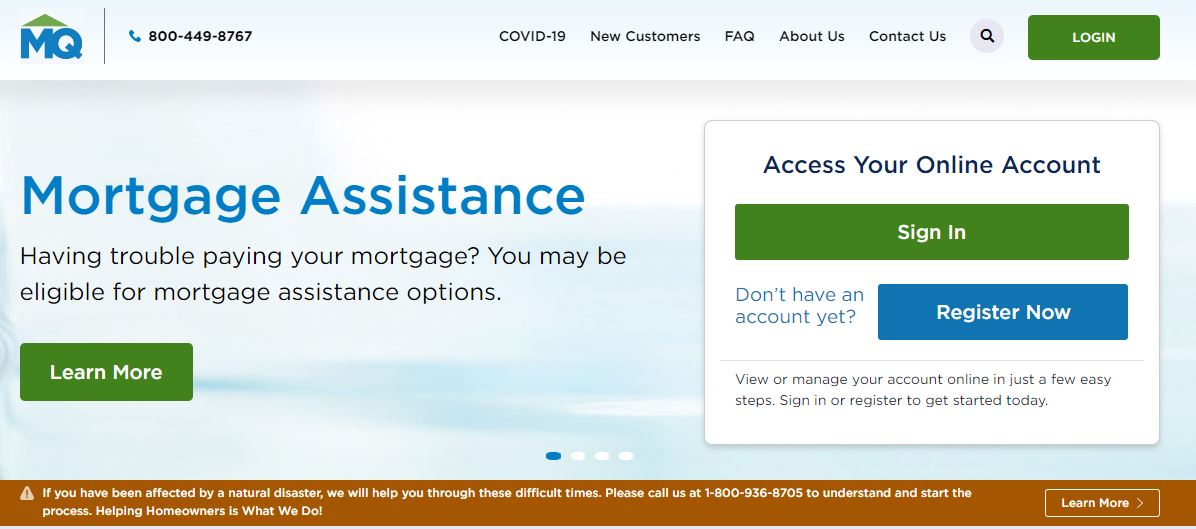

About Mortgagequestions.com Portal

www.mortgagequestions.com is a website that provides a convenient way for homeowners to manage their mortgage accounts online. It is owned and operated by PHH Mortgage Corporation, which is a subsidiary of Ocwen Financial Corporation. Through the Mortgagequestions.com website, homeowners can access their mortgage statements, make payments, update their personal information, and get answers to frequently asked questions. The website is user-friendly and provides helpful resources during home buying to make managing a mortgage account more efficient and convenient. Additionally, Mortgagequestions.com takes several security measures to protect the personal and financial information of its users.

Why To Use Mortgagequestions.com Portal?

Mortgagequestions.com provides homeowners with a simple and convenient way to manage their mortgage accounts online. Some of the benefits of using Mortgagequestions.com include:

- 24/7 access to your mortgage account information

- Online payment options

- Easy access to important mortgage documents

- Ability to update your personal information

- Useful resources to help manage your mortgage account

Mortgagequestions Features

The Mortgagequestions.com dashboard is your home base for managing your mortgage loan. From here, you can access your loan information, make payments, and even submit requests for help. Here’s an overview of the dashboard:

- Loan Information: This section provides a summary of your loan, including the amount you owe, the interest rate, and the due date of your next payment.

- Payment Options: This section allows you to make a payment, set up recurring payments, and even pay off your loan early.

- Escrow Information: This section provides information on your escrow account, including the amount held and any upcoming payments.

- Personal Information: This section allows you to update your contact information, such as your phone number and email address.

- Help and Support: This section provides access to frequently asked questions, support articles, and the ability to submit a request for help.

Benefits of Using Mortgagequestions.com Portal

Using Mortgagequestions provides several benefits, including:

- Convenience: You can access your mortgage loan information 24/7 from anywhere with an internet connection.

- Easy Payments: Making payments is straightforward and can be done in just a few clicks.

- Up-to-date Information: You can view your loan information and payment history in real time.

- Customer Support: Mortgagequestions.com provides access to a support team to help with any questions or issues.

Mortgagequestions Registration: How to Sign Up for Mortgagequestions.com?

To access Mortgagequestions.com, you need to create an account. The Mortgagequestions Registration process is straightforward and can be done in a few simple steps. Here’s how to register:

- Visit the MortgageQuestions website at www.mortgagequestions.com

- Click on the “Register” button on the top right corner of the homepage.

- Enter your loan number, the last four digits of your social security number, and your email address.

- Create a username and password.

- Fill out your personal information and contact details.

- Agree to the terms and conditions, and you’re all set.

- Click on “Register.”

Once you have completed these steps, your account will be created, and you can log in to access your mortgage account.

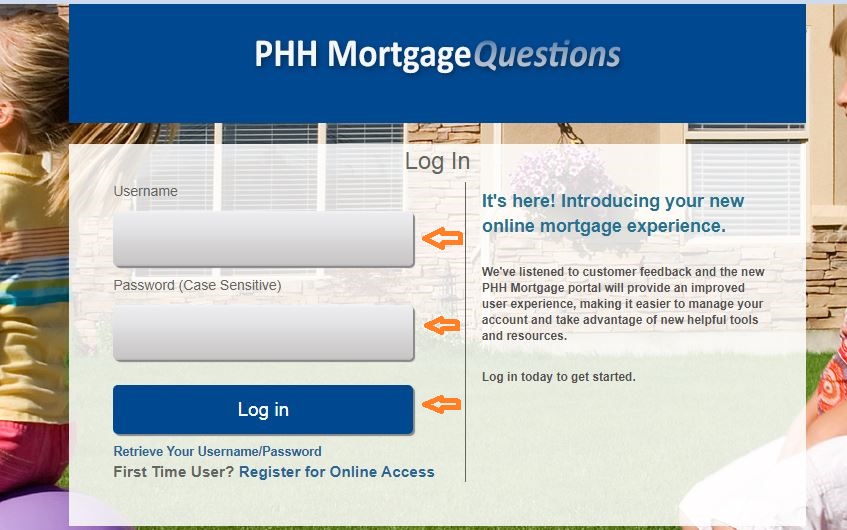

Mortgagequestions Login: How to Sign In to Your Mortgagequestions.com Account?

Once you have registered for an account, you can log in anytime to access your loan information. Here’s how Do Mortgagequestions Login:

- Go to the MortgageQuestions website at www.mortgagequestions.com

- Click on the “Log In” button on the top right corner of the homepage.

- Enter your username and password.

- Click on “Log In.”

- Now you’ll be redirected to your account.

Once you have logged in to your account, you will be able to view your account details, make payments, and manage your mortgage account.

How to Reset Your Mortgagequestions Login Password?

If you forget your Mortgagequestions.com password, follow these steps to Reset Mortgagequestions Password:

- Go to Mortgagequestions.com.

- Click on the “Forgot your password?” link.

- Enter your username and the email address associated with your account.

- Click on “Submit.”

- Follow the instructions to reset your password.

How To Make Mortgagequestions Payments Online?

Making payments on Mortgagequestions.com is simple and convenient. Here’s how to make Mortgagequestions Payment:

- Visit the MortgageQuestions website at www.mortgagequestions.com

- Now Log in to your account.

- Click on the “Payment Options” Section on the Dashboard.

- Select the Payment method you prefer, such as a one-time payment or recurring payment.

- Follow the prompts to complete the payment.

How to Contact Mortgagequestions Customer Support?

If you have any issues with your Mortgagequestions account, you can contact the Mortgagequestions Customer Support Team. You need to follow these steps to contact them:

- Go to Mortgagequestions.com.

- Click on the “Contact Us” link.

- Select the option that best describes your issue.

- Follow the instructions to contact customer support.

Mortgagequestions Toll-free Number: 1-800-449-8767

You can contact them by Phone using the Mortgagequestions Customer support number from Monday to Friday 8 AM to 9 PM and on Saturday from 8 AM to 5 PM.

Mortgagequestions Email Address: [email protected]

Mortgagequestions Mailing Address:

General Mail

P.O. Box 5452

Mount Laurel, NJ 08054-5452

Mortgage Accounts

PHH Mortgage Services

P.O. Box 94087

Palatine, IL 60094-4087

HELOC Accounts

PHH Mortgage Services

P.O. Box 0055

Palatine, IL 60055-0055

Tips for Using Mortgagequestions Portal Efficiently

Here are some tips to help you use Mortgagequestions.com efficiently:

- Keep your Login credentials safe and secure.

- Regularly update your personal information on the website.

- Make payments on time to avoid late fees and penalties.

- Utilize the resources provided by Mortgagequestions.com to manage your mortgage account effectively.

Homeowners Assistance At MortgageQuestions

If you are struggling to Pay your Monthly Mortgage, then PHH Mortgage may be able to help you out with its Homeowners Assistance options. These programs will ease some of your burden while allowing homeowners to still keep their Home. Some of the available options include:

- Loan Modification

- Hardest Hit Fund

- Natural Disaster

- Forbearance Plan

- Repayment Plan

If you have already tried all possible options yet are still unable to pay your Mortgage Loan, Then PHH Mortgage still has more options that may be able to help homebuyers avoid foreclosure:

- Pre-Foreclosure Sale

- Deed in Lieu

The homeowners have to check out all the programs available to them and utilize them as much as possible just so they can keep their beloved home.

Final Verdict

MortgageQuestions is a platform that provides a range of services related to mortgages. It is owned and operated by PHH Mortgage, which is one of the largest mortgage companies in the United States. MortgageQuestions is a valuable platform for anyone who has a mortgage or is looking to get a mortgage. It provides a range of features and services that can help borrowers manage their mortgages, make payments, and access educational resources. By using MortgageQuestions, borrowers can enjoy greater convenience, access useful information, and get the support they need to manage their mortgages effectively.

Frequently Asked Questions (FAQs)

Question 1: What is Mortgagequestions.com?

Answer: Mortgagequestions.com is a website designed to help homeowners manage their mortgage accounts online. It is owned and operated by PHH Mortgage Corporation, a subsidiary of Ocwen Financial Corporation.

Question 2: Is it safe to use Mortgagequestions.com?

Answer: Yes, Mortgagequestions.com uses secure encryption to protect your personal and financial information.

Question 3: Can I make a one-time payment or set up automatic payments?

Answer: Yes, you can make a one-time payment or set up automatic payments to ensure that your payments are always made on time.

Question 4: What if I have trouble logging in to my account?

Answer: If you have trouble logging in to your account, you can contact customer service for assistance.

Question 5: Can I view my escrow account balance and make payments through Mortgagequestions.com?

Answer: Yes, you can view your escrow account balance and make payments through Mortgagequestions.com.

Question 6: Is Mortgagequestions.com only for PHH Mortgage customers?

Answer: Yes, Mortgagequestions.com is owned by PHH Mortgage and is only available to PHH Mortgage customers.

Question 7: How do I register on Mortgagequestions.com?

Answer: To register on Mortgagequestions.com, you will need your loan number, the last four digits of your social security number, and a valid email address. Visit the website and click on the “Register” button to get started.

Question 8: How do I log in to my Mortgagequestions.com account?

Answer: To log in to your Mortgagequestions.com account, enter your username and password on the homepage of the website and click on the “Log In” button.

Question 9: How do I reset my Mortgagequestions.com password?

Answer: To reset your Mortgagequestions.com password, click on the “Forgot Password” link on the login page. You will be prompted to enter your username and email address, and you will receive instructions on how to reset your password.

Question 10: How do I make a payment on Mortgagequestions.com?

Answer: To make a payment on Mortgagequestions.com, log in to your account and click on the “Make a Payment” button. You can make a one-time payment or set up automatic payments for your mortgage.

You May Also Read

- What Is Mortgage Principal: Benefits, How To Pay Off, How To Qualify & Other Details!

- What Is Mortgage Recasting: Reviews, How They Work, Requirements & Other Details!

- What Is Mortgage Refinancing: Reviews, Types, How They Work, Ways To Refinance & More

- What Is Variable-rate Loan: Reviews, Types, Benefits, How They Work, And Other Details!

- What Is Piggyback Loan: Reviews, Benefits, Types, How To Apply & Other Details

- What Is Annual Percentage Rate (APR): Types, How To Calculate & Other Details!

- What Is Loan-to-value Ratio (LTV): Requirement, How To Calculate & Other Details!

- Portfolio Loans: Reviews, Types, Benefits, Eligibility, How They Work & Other Details!

- PHH Mortgage Login, Registration, Reverse Mortgage And Customer Service Details

- What Is Mortgagequestions: Here Is Everything To Know About!

- Mortgagequestions Login To Access Online Account At www.mortgagequestions.com

- Mortgagequestions Features, Benefits And Customer Support

- Mortgagequestions Bill Payment Online At Mortgagequestions.com

- What Is Credit Score In Mortgage: How They Work, How To Improve It, & Other Details!

- Home Buying Guide: A Step By Step Complete Home Hunting & Purchasing Ideas!

- What Are Closing Costs: How Much They, Whats Included And Other Details!

- What Is Mortgage Payment: How Do They Work, Ways To Make Payment & More

- What Is Mortgage Rate: Types, Determining Factors, Methods To Lower And More